Our History

1894

John Tappan, age 24, founds Investors Syndicate in Minneapolis, Minnesota. To provide financial solutions to Middle America and give smaller investors access to more benefits, Tappan introduces the Face Amount Certificate, an innovative and democratizing investment idea.

1907

The Panic of 1907 spreads through the country, bankrupts brokerage firms and prompts investors to pull their money out of banks. Unlike many institutions during the financial crisis, Investors Syndicate survives and keeps its clients' money working.

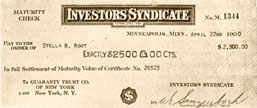

1929

The Great Depression lasts a decade. Thousands of financial institutions fail, countless people are left penniless. Meanwhile, Investor Syndicate pays out every dollar on its due date - a total of $101 million - to its clients.

1939

Investors Syndicate provides career opportunities for people from all walks of life. Former schoolteachers, beekeepers, housewives, waiters and secretaries join its ranks.

1949

Investors Syndicate renames itself Investors Diversified Services (henceforth called IDS) to more clearly indicate its growing range of products and services. In the next decade, IDS becomes the largest investment company in the US.

1957

IDS founds the Investors Syndicate Life Insurance and Annuity Company and offers life insurance to help protect and preserve the financial well-being of clients. The company is eventually renamed the IDS Life Insurance Company.

1973

Investors Syndicate Life Insurance and Annuity Company becomes IDS Life Insurance Company.

1984

American Express Company acquires IDS.

2005

American Express Financial Advisors is renamed Ameriprise Financial. The name Ameriprise is a blend of "American" and "Enterprise."

Ameriprise Financial becomes an independent, publicly owned company with more than 12,000 advisors and registered representatives and more than 2.7 million individual, business and institutional clients.

Ameriprise Financial announces the RiverSource brand. The brand includes insurance, annuities and investment products and is focused on growing and protecting client income through retirement.

2008

Global economic crisis drives broad stock market declines.

When the independent Reserve Fund "breaks the buck" in one of its money market funds and freezes assets, Ameriprise Financial responds by advancing $700 million to help meet clients' immediate cash needs and developing extensive market volatility resources for advisors to help their clients.

2009

Financially healthy, Ameriprise Financial refuses TARP funding.

Today

As we did through the 2008-2009 financial crisis, RiverSource Life Insurance Company and RiverSource Life Insurance Co. of New York continue to maintain strong ratings from independent ratings agencies.